Subscribe To Our Newsletter

Subscribe to our newsletter and receive free educational articles and videos each month.

Education

You will find key information and pertinent articles here to help you plan and achieve a Successful Retirement. You will learn about the important factors that can greatly impact your retirement / financial plan and what can be done about them. Our goal is to help you become familiar with all the facts, issues and important considerations when you start planning for a Successful Retirement. We will be posting new items from time to time, so check back to keep abreast of What’s New.

Not sure of your Successful Retirement Number ? Give us a call to find out.

Subscribe To Our Newsletter

Subscribe to our newsletter and receive free educational articles and videos each month.

Education

You will find key information and pertinent articles here to help you plan and achieve a Successful Retirement. You will learn about the important factors that can greatly impact your retirement / financial plan and what can be done about them. Our goal is to help you become familiar with all the facts, issues and important considerations when you start planning for a Successful Retirement. We will be posting new items from time to time, so check back to keep abreast of What’s New.

Not sure of your Successful Retirement Number ? Give us a call to find out.

Main Menu

Are you confident that you will achieve a successful retirement? That is, a lifestyle sustaining income and a legacy for those you love. Or have you been at all concerned that at some point during your retirement, you might actually run out of money?

Achieving A Successful Retirement

Are you confident that you will achieve a successful retirement? That is, a lifestyle sustaining income and a legacy for those you love. Or have you been at all concerned that at some point during your retirement, you might actually run out of money?

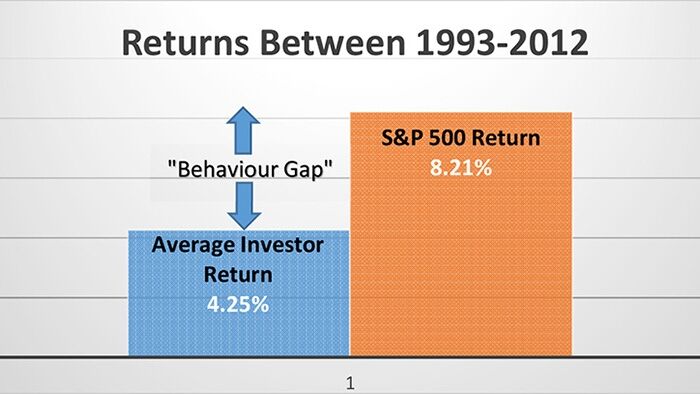

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

The Behavior Gap

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

What is a Bear Market? What should you know about Bear Markets? More importantly, what should you as an investor, do during a Bear Market?

Read the Bear Market series for answers to all these questions and more. Each remaining part of this series will be published on a monthly basis. Please check back.

Bear Markets Parts 1 – 4

What is a Bear Market? What should you know about Bear Markets? More importantly, what should you as an investor, do during a Bear Market?

Read the Bear Market series for answers to all these questions and more. Each remaining part of this series will be published on a monthly basis. Please check back.

Need help with financial terms like “Dollar Cost Averaging”, “GIC” and “Compound Interest”? Do you know what the “Rule of 72” is? Start building your financial knowledge by watching these quick, fun videos on an assortment of topics in the Financial Foundations library.

Financial Foundations

Need help with financial terms like “Dollar Cost Averaging”, “GIC” and “Compound Interest”? Do you know what the “Rule of 72” is? Start building your financial knowledge by watching these quick, fun videos on an assortment of topics in the Financial Foundations library.